| Rainbow Score (BRS) |

- Signaux d’achat et de vente.

- Changement de zone 9 à 10.

- Changement de zone 8 à 9.

- Changement de zone 3 à 2.

- Changement de zone 2 à 1.

|

- {Asset}: {Buy/Sell} signal on timeframe {tf}.

- {Asset} entered score {1/2/9/10} on timeframe {tf}.

|

|

| Unyx Bands (BUB) |

- Signaux de trading (Long, Short, Close, Stop Loss).

|

- {Asset}: Open {Long/Short} on timeframe {tf}.

- {Asset}: {Trend Stop Loss/Stop Loss} Close {Long/Short} on timeframe {tf}.

|

|

| Bitcoin Cycle Synthesis (BCS) |

BCS 1/2

- Confirmation de Bullmarket/Bearmarket.

- MM200 en zone d’achat ou de vente.

- Signaux de Top/Bottom.

BCS 2/2 (Oscillator)

- RSI entre dans la zone d’achat/vente.

- Signal d’achat du Hash Ribbon.

- Puell Multiple entre/quitte la zone d’achat/vente.

|

- {Bullmarket/Bearmarket} confirmed!

- 200 Moving Average enters {Buy/Sell} zone on timeframe {tf}.

- {Top/Bottom} signal on timeframe {tf}.

- RSI enters {Buy/Sell} zone on timeframe {tf}.

- Hash Ribbon enters Buy zone on timeframe {tf}.

- Puell Multiple {enters/exits} {Buy/Sell} zone on timeframe {tf}.

|

|

| Ultimatyx Screener & Oscillator (BUX) |

BUO (Oscillator)

- Signal de fort surachat ou de forte survente.

|

- {Asset}: {Overbought/Oversold} signal on timeframe {tf}.

|

|

| On-chain Suite (BOS) |

- Pourcentages de plus ou de moins détenus par les Whales sur 7 jours (uniquement si variation de -/+ 3%).

- Nombre de Whales en plus ou en moins sur 7 jours, ainsi que la part de l’offre détenue.

|

- {X}% {more/less} held by whales on {Asset} over the last 7 days.

- {X} {new/less} whales since last week, for a total of {X}, holding {X}% of the {Asset} supply.

|

|

| Reversal Identifier (BRI) |

- Signaux d’achat et vente du BSR.

- Signaux d’achat et vente du RSI Slope.

- Signaux de Breakout haussier et baissier.

- Signaux de Trap.

|

- {Asset}: {Buy/Sell} signal from BSR on timeframe {tf}.

- {Asset}: {Buy/Sell} signal from RSI Slope on timeframe {tf}.

- {Asset}: {Bullish/Bearish} {Breakout/Trap} on timeframe {tf}.

|

|

| Trend Identifier (BTI) |

- Le Vegas Daily change de tendance.

- Signal de retest du Vegas Daily.

|

- {Asset}: Daily Vegas Cloud is now {Bullish/Bearish}.

- {Asset}: Daily Vegas Cloud {bullish/bearish} retest in progress.

|

|

| Pivot Identifier (BPI) |

- Nouvel ATH ou ATL.

- Nouvel ATH ou ATL intermédiaire.

|

- {Asset} reached a new All Time {High/Low} at {$X}.

- {Asset} reached a new Intermediate All Time {High/Low} at {$X}.

|

|

| Drawdown Visualizer (BDV) |

- Nouveau Max Drawdown.

- Drawdown passe sous -25% / Drawdown récupère -25%.

- Drawdown passe sous -50% / Drawdown récupère -50%.

- Drawdown passe sous -75% / Drawdown récupère -75%.

|

- {Asset} reached a new Max Drawdown at ${X}.

- {Asset} {reclaimed/crossed under} {-75%/-50%/-25%} Drawdown.

|

|

| Volatility Bands (BVB) |

- Signaux de trading (Long, Short, Close, Stop Loss).

|

- {Asset} enter {first/second/third} {long /short} position on timeframe {tf}.

- {Asset}: Close all positions on timeframe {tf}.

|

|

| Bitcoin ETF Tracker (BET) |

- Variation du volume total en 24h (si variation -/+ 50%).

|

- Total Volume of Bitcoin ETFs has changed by {X}% over the last 24 hours.

|

|

| Excess Index (BEI) |

- Signaux d’achat ou de vente.

- Dépassement de l’extension supérieure ou inférieure.

|

- {Asset}: {Buy/Sell} signal from BSR on timeframe {tf}.

- {Asset} exits {upper/lower} extension on timeframe {tf}

|

|

| Stablecoin Liquidity (BSL) |

- Etat et taux de variation de la liquidité agrégée sur 30j (alerte envoyée tous les 30 jours).

|

- Aggregated Stablecoin Liquidity is at ${X} with a monthly variation of {X}%.

|

|

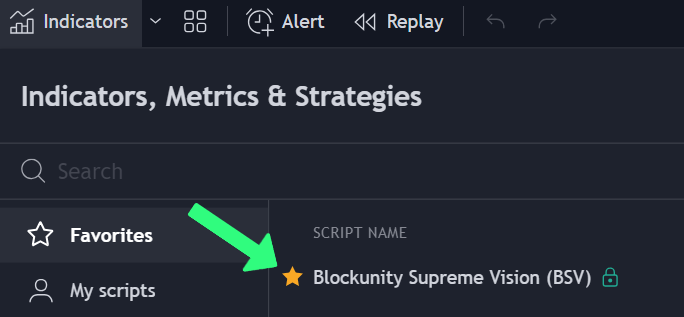

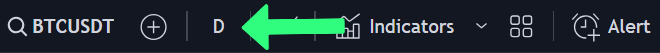

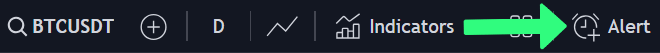

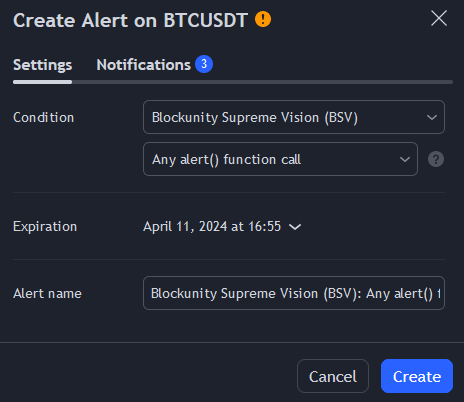

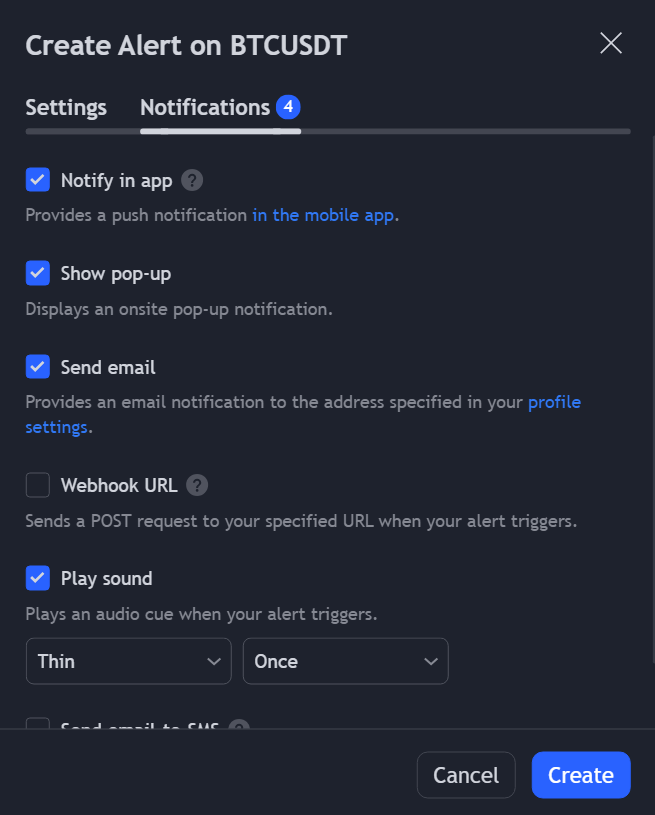

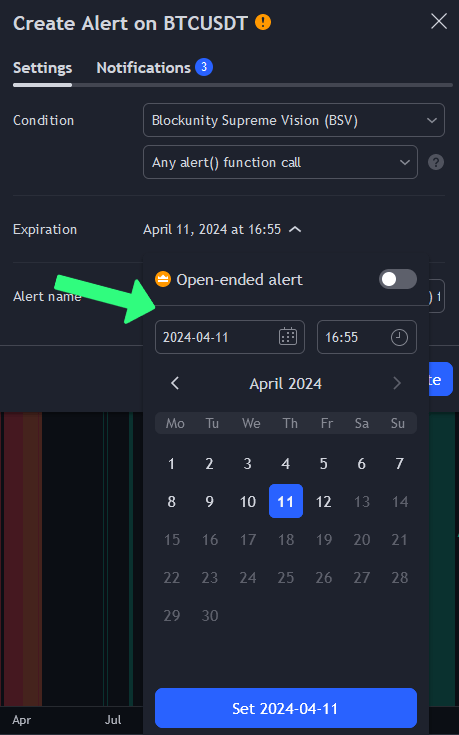

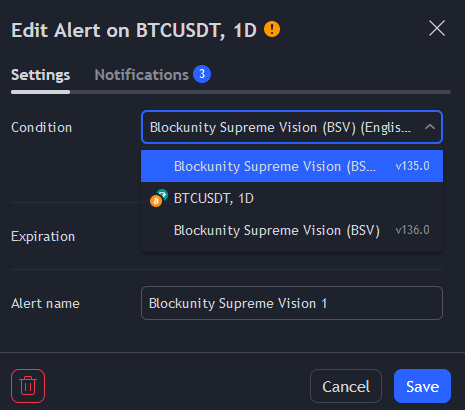

| Supreme Vision (BSV) |

- Signaux d’achat ou de vente.

- Entrée en zone d’Accumulation / de Distribution / d’Attention.

- Récapitulatif mensuel de la tendance de l’actif et de celle du marché, ainsi que de la zone d’état et du drawdown de l’actif.

|

- {Asset}: {Buy/Sell} signal on timeframe {tf}.

- {Asset} entering {Accumulation/Distribution/Caution} zone on timeframe {tf}.

- End of month BSV Recap: {Asset} trend is {Bullish/Bearish/Contested} and state is in {Accumulation/Distribution/Caution} zone. Market state is {Oversold/Overbought/Neutral}. Drawdown is {X}%.

|

|

| Gap Detector (BGD) |

|

|

|

| Fibonacci Score (BFS) |

- L’actif entre dans les zones de retracement 0,1,ou 2 sur le “all time history”.

|

- {Asset} has now a retracement score of {0/1/2} on all time history.

|

|

| Altseason Index (BAI) |

- Changement d’état de la saisonnalité.

- Récapitulatif mensuel de l’état de la saisonnalité, de la dominance de Bitcoin, ainsi que du ratio de l’index.

|

- State of seasonality change: {State}.

- End of month Altseason Index recap: Bitcoin Dominance is at {X}%. BTC Dominance (Excluding Stablecoins) is at {X}%. Index Ratio is at {X}. {State}.

|

|

| Market Index (BMI) |

- Changement de tendance du marché.

- Récapitulatif mensuel de la tendance du marché, ainsi que du ratio de l’index.

|

- New {Market} Market Trend: {Bullish/Bearish/Neutral} ({tf}).

- {Market} Market Index end of month recap: Trend is {Bullish/Bearish/Neutral}. Index at {X}/{X}. Ratio is {X}% Bull.

|

|

| |

|

|

|

| Money Printer Index (BMP) |

- Changement d’état de l’impression.

|

- Money Printer Index changes state to: {Printing Brrrr/Decreasing/Increasing/No Printing}.

|

|

| Central Banks Variation (BBV) |

- Récapitulatif hebdomadaire avec la variation sur 7j.

- Récapitulatif mensuel avec la variation sur 30j.

- Récapitulatif trimestrielle avec la variation sur 90j.

|

- Central Bank Variations {weekly/monthly/quarterly} change: {X}%.

|

|

| Ownership Segmentation (BOS) |

- Récapitulatif mensuel du pourcentage de Whales, d’Investors, et de Retail.

|

- Ownership Segmentation end of month recap. Whales: {X}%. Investors: {X}%. Retail: {X}%.

|

|

| Profile Segmentation (BPS) |

- Récapitulatif mensuel du pourcentage de Hodlers, de Cruisers, et de Traders.

|

- Profile Segmentation end of month recap. Hodlers: {X}%. Cruisers: {X}%. Traders: {X}%.

|

|

| |

|

|

|

| Magic Bands (PMB) |

- Signaux d’achat et de vente (dont les signaux précoces).

- Changement de zone 9 à 10.

- Changement de zone 8 à 9.

- Changement de zone 3 à 2.

- Changement de zone 2 à 1.

- Tendance devient Bullish/Bearish.

|

- {Asset}: {[Early] Buy/Sell} signal on timeframe {tf}.

- {Asset} entered zone {1/2/9/10} on timeframe {tf}.

- {Asset} trend is now {Bullish/Bearish} on timeframe {tf}.

|

|

| Trend Time (PTT) |

- Temps en tendance > 60 jours.

- Temps en tendance > 90 jours.

- Temps en tendance > 120 jours.

|

- {Asset} in {Bullish/Bearish/Contested} trend for {60/90/120} days.

|

|

| Divinetrend (BDT) |

|

- {Asset} trend changes to {Bullish/Bearish/Contested} on timeframe {tf}.

|

|

| Supply Augmentation (PSA) |

- Pourcentage de variation de l’offre (uniquement si -/+ 3%).

|

- {Asset}: In the last 24 hours the supply {increased/decreased} by {X}%.

|

|

| Master Oscillator (BMO) |

- Les adresses en profit dépassent 90% ou passent sous 10%.

- De forts profits ou pertes sont réalisés.

- Variation de la proportion des baleines sur 30 jours (seulement si la variation est de +/- 3%).

- Variation de la proportion des holders long terme sur 30 jours (seulement si la variation est de +/- 5%).

- L’actif entre en fort surachat ou en forte survente.

- Récapitulatif mensuel du pourcentage d’adresses en profit, de la proportion des Whales et des Holders long terme, de l’état de la liquidité du marché, ainsi que de l’état de surchauffe de l’actif.

|

- {Asset} addresses in profit represent now {X}%.

- {Asset} high amount of {losses/profits} realized today! (Index at: {X}/100).

- {Asset}: {Whales proportion/Long-term Holders} varied by {X}% over the last 30 days!

- {Asset} is {[Heavily] Oversold/Overbought} on timeframe {tf}.

- End of month BMO recap for {Asset}: The proportion of Addresses in Profit is {X}%. The Whales proportion is {X}%. Long-term Holders represent {X}%. The Stablecoin Liquidity is {Increasing/Decreasing}. The FIAT printing state is {Printing Brrrr/Decreasing/Increasing/No Printing}. And {Asset} is in a {[Heavily] Oversold/Overbought} state.

|

|