| Rainbow Score (BRS) |

- Buy and sell signals.

- Change from zone 9 to 10.

- Change from zone 8 to 9.

- Change from zone 3 to 2.

- Change from zone 2 to 1.

|

- {Asset}: {Buy/Sell} signal on timeframe {tf}.

- {Asset} entered score {1/2/9/10} on timeframe {tf}.

|

|

| Unyx Bands (BUB) |

- Trading signals (Long, Short, Close, Stop Loss).

|

- {Asset}: Open {Long/Short} on timeframe {tf}.

- {Asset}: {Trend Stop Loss/Stop Loss} Close {Long/Short} on timeframe {tf}.

|

|

| Bitcoin Cycle Synthesis (BCS) |

BCS 1/2

- Bullmarket/Bearmarket confirmation.

- MM200 in buy or sell zone.

- Top/Bottom signals.

BCS 2/2 (Oscillator)

- RSI enters buy/sell zone.

- Hash Ribbon buy signal.

- Puell Multiple enters/leaves buy/sell zone.

|

- {Bullmarket/Bearmarket} confirmed!

- 200 Moving Average enters {Buy/Sell} zone on timeframe {tf}.

- {Top/Bottom} signal on timeframe {tf}.

- RSI enters {Buy/Sell} zone on timeframe {tf}.

- Hash Ribbon enters Buy zone on timeframe {tf}.

- Puell Multiple {enters/exits} {Buy/Sell} zone on timeframe {tf}.

|

|

| Ultimatyx Screener & Oscillator (BUX) |

BUO (Oscillator)

- Strong overbought or oversold signal.

|

- {Asset}: {Overbought/Oversold} signal on timeframe {tf}.

|

|

| On-chain Suite (BOS) |

- Percentage over/under held by Whales over 7 days (only if variation of -/+ 3%).

- Number of Whales up or down over 7 days, as well as the percentage of the offer held.

|

- {X}% {more/less} held by whales on {Asset} over the last 7 days.

- {X} {new/less} whales since last week, for a total of {X}, holding {X}% of the {Asset} supply.

|

|

| Reversal Identifier (BRI) |

- BSR buy and sell signals.

- RSI Slope buy and sell signals.

- Bullish and bearish breakout signals.

- Trap signals.

|

- {Asset}: {Buy/Sell} signal from BSR on timeframe {tf}.

- {Asset}: {Buy/Sell} signal from RSI Slope on timeframe {tf}.

- {Asset}: {Bullish/Bearish} {Breakout/Trap} on timeframe {tf}.

|

|

| Trend Identifier (BTI) |

- Vegas Daily changes trend.

- Vegas Daily retest signal.

|

- {Asset}: Daily Vegas Cloud is now {Bullish/Bearish}.

- {Asset}: Daily Vegas Cloud {bullish/bearish} retest in progress.

|

|

| Pivot Identifier (BPI) |

- New ATH or ATL.

- New intermediate ATH or ATL.

|

- {Asset} reached a new All Time {High/Low} at {$X}.

- {Asset} reached a new Intermediate All Time {High/Low} at {$X}.

|

|

| Drawdown Visualizer (BDV) |

- New Max Drawdown.

- Drawdown falls below -25% / Drawdown recovers -25%.

- Drawdown falls below -50% / Drawdown recovers -50%.

- Drawdown falls below -75% / Drawdown recovers -75%.

|

- {Asset} reached a new Max Drawdown at ${X}.

- {Asset} {reclaimed/crossed under} {-75%/-50%/-25%} Drawdown.

|

|

| Volatility Bands (BVB) |

- Trading signals (Long, Short, Close, Stop Loss).

|

- {Asset} enter {first/second/third} {long /short} position on timeframe {tf}.

- {Asset}: Close all positions on timeframe {tf}.

|

|

| Bitcoin ETF Tracker (BET) |

- Total volume variation in 24h (if variation -/+ 50%).

|

- Total Volume of Bitcoin ETFs has changed by {X}% over the last 24 hours.

|

|

| Excess Index (BEI) |

- Buy or sell signals.

- Exceeding upper or lower extension.

|

- {Asset}: {Buy/Sell} signal from BSR on timeframe {tf}.

- {Asset} exits {upper/lower} extension on timeframe {tf}

|

|

| Stablecoin Liquidity (BSL) |

- Aggregate liquidity status and variation over 30 days (alert sent every 30 days).

|

- Aggregated Stablecoin Liquidity is at ${X} with a monthly variation of {X}%.

|

|

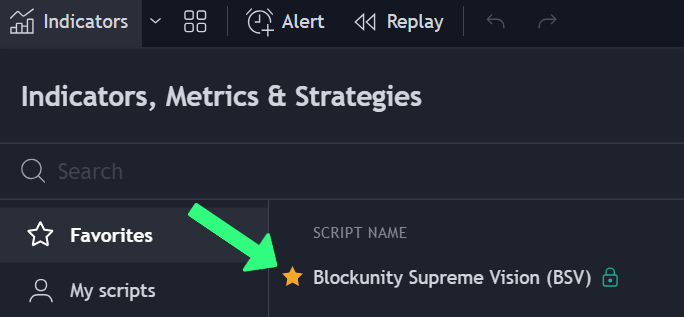

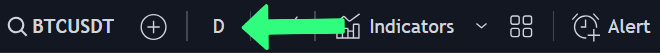

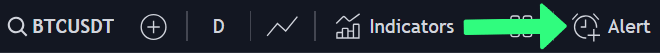

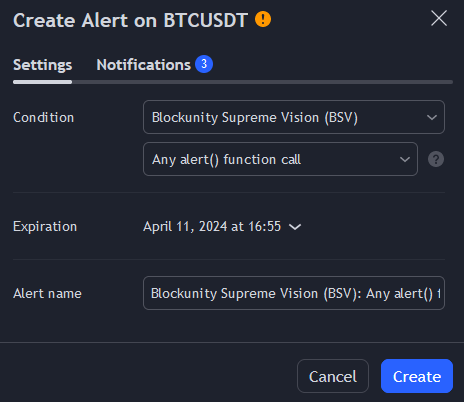

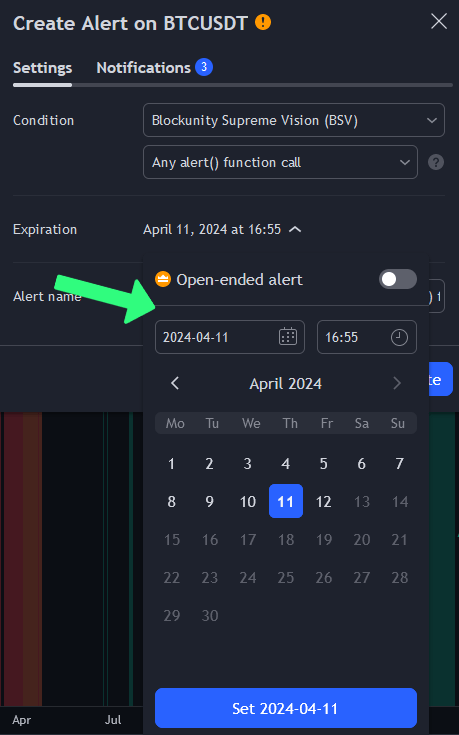

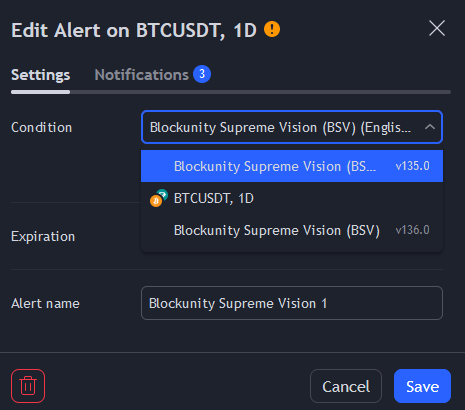

| Supreme Vision (BSV) |

- Buy or sell signals.

- Entry into Accumulation / Distribution / Caution zones.

- Monthly summary of asset and market trends, as well as asset state zone and drawdown.

|

- {Asset}: {Buy/Sell} signal on timeframe {tf}.

- {Asset} entering {Accumulation/Distribution/Caution} zone on timeframe {tf}.

- End of month BSV Recap: {Asset} trend is {Bullish/Bearish/Contested} and state is in {Accumulation/Distribution/Caution} zone. Market state is {Oversold/Overbought/Neutral}. Drawdown is {X}%.

|

|

| Gap Detector (BGD) |

|

|

|

| Fibonacci Score (BFS) |

- The asset enters the 0, 1 or 2 retracement zones on the “all time history”.

|

- {Asset} has now a retracement score of {0/1/2} on all time history.

|

|

| Altseason Index (BAI) |

- Change in seasonality state.

- Monthly summary of seasonality state, Bitcoin dominance and index ratio.

|

- State of seasonality change: {State}.

- End of month Altseason Index recap: Bitcoin Dominance is at {X}%. BTC Dominance (Excluding Stablecoins) is at {X}%. Index Ratio is at {X}. {State}.

|

|

| Market Index (BMI) |

- Change in market trend.

- Monthly summary of market trend and index ratio.

|

- New {Market} Market Trend: {Bullish/Bearish/Neutral} ({tf}).

- {Market} Market Index end of month recap: Trend is {Bullish/Bearish/Neutral}. Index at {X}/{X}. Ratio is {X}% Bull.

|

|

| |

|

|

|

| Money Printer Index (BMP) |

|

- Money Printer Index changes state to: {Printing Brrrr/Decreasing/Increasing/No Printing}.

|

|

| Central Banks Variation (BBV) |

- Weekly summary with 7-day variation.

- Monthly summary with 30-day variation.

- Quarterly summary with 90-day variation.

|

- Central Bank Variations {weekly/monthly/quarterly} change: {X}%.

|

|

| Ownership Segmentation (BOS) |

- Monthly summary of the percentage of Whales, Investors and Retail.

|

- Ownership Segmentation end of month recap. Whales: {X}%. Investors: {X}%. Retail: {X}%.

|

|

| Profile Segmentation (BPS) |

- Monthly summary of Hodlers, Cruisers and Traders percentages.

|

- Profile Segmentation end of month recap. Hodlers: {X}%. Cruisers: {X}%. Traders: {X}%.

|

|

| |

|

|

|

| Magic Bands (PMB) |

- Buy and sell signals (including early signals).

- Change from zone 9 to 10.

- Change from zone 8 to 9.

- Change from zone 3 to 2.

- Change from zone 2 to 1.

- Trend becomes Bullish/Bearish.

|

- {Asset}: {[Early] Buy/Sell} signal on timeframe {tf}.

- {Asset} entered zone {1/2/9/10} on timeframe {tf}.

- {Asset} trend is now {Bullish/Bearish} on timeframe {tf}.

|

|

| Trend Time (PTT) |

- Trend time > 60 days.

- Trend time > 90 days.

- Trend time > 120 days.

|

- {Asset} in {Bullish/Bearish/Contested} trend for {60/90/120} days.

|

|

| Divinetrend (BDT) |

|

- {Asset} trend changes to {Bullish/Bearish/Contested} on timeframe {tf}.

|

|

| Supply Augmentation (PSA) |

- Percentage change in supply (only if -/+ 3%).

|

- {Asset}: In the last 24 hours the supply {increased/decreased} by {X}%.

|

|

| Master Oscillator (BMO) |

- Addresses in profit surpass 90% or fall below 10%.

- Strong realized profits or losses.

- Variation in the proportion of whales over 30 days (only if the variation is +/- 3%).

- Variation in the proportion of long-term holders over 30 days (only if the variation is +/- 5%).

- Asset enters strong overbought or oversold condition.

- Monthly summary of the percentage of addresses in profit, the proportion of Whales and long-term Holders, the state of market liquidity, and the asset’s state of overheating.

|

- {Asset} addresses in profit represent now {X}%.

- {Asset} high amount of {losses/profits} realized today! (Index at: {X}/100).

- {Asset}: {Whales proportion/Long-term Holders} varied by {X}% over the last 30 days!

- {Asset} is {[Heavily] Oversold/Overbought} on timeframe {tf}.

- End of month BMO recap for {Asset}: The proportion of Addresses in Profit is {X}%. The Whales proportion is {X}%. Long-term Holders represent {X}%. The Stablecoin Liquidity is {Increasing/Decreasing}. The FIAT printing state is {Printing Brrrr/Decreasing/Increasing/No Printing}. And {Asset} is in a {[Heavily] Oversold/Overbought} state.

|

|